Investing in cryptocurrencies means you also have to deal with taxes in most countries. And it can get quite confusing at times. But, there are actually crypto tax tools you can find that can make this a lot easier.

However, a lot of these crypto tax tools can be expensive. That’s why I’ve decided to make a tutorial on the best free crypto tax tool around. What I’m pertaining to is Crypto.com’s free tax tool.

In this guide, I will talk about what you can do with the recently launched tool of Crypto.com. That way, you will know the ins and outs of this software so you can determine if it is for you or not.

What is Crypto.com Tax?

Crypto.com Tax is a tax software that is free to use. All you have to do is visit the Crypto.com Tax website and sign up as a member to access the features.

Once you’ve signed up as a member, all you have to do is log in and you will gain access to all the features of the software.

I will discuss in the succeeding sections what you need to do to use this software properly.

Which platforms can you connect to Crypto.com Tax?

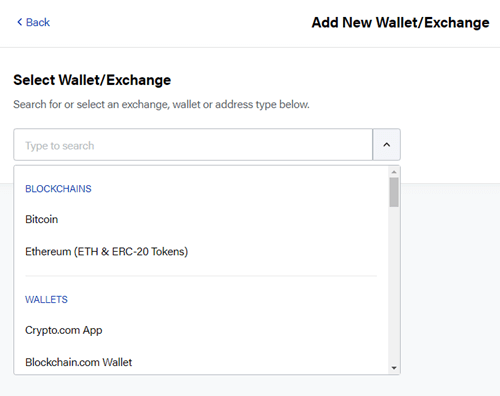

The good thing about the Crypto.com Tax tool is that you will be able to use it with different crypto platforms. This, in my opinion, is where this software really shines. Some of the crypto tax tools you can find on the internet will only work with specific crypto trading platforms.

But with Crypto.com Tax, you will be able to link the most popular and most used crypto trading platforms which makes it really useful because you will be able to track all your transactions.

As you can see in the photo above, it works with Binance, Coinbase, FTX, and more. These are the most popular crypto exchange/trading platforms today.

Aside from that, if you’re using other exchanges/wallets that aren’t very popular, you can still use the generic CSV format the software provides to get your tax calculation results. Hence, I would consider this tool a very flexible crypto tax tool.

And as I’ve mentioned, it is completely free to use which is very unusual because most tax tools have to either be bought or they have a monthly subscription fee.

How to add wallets and exchanges?

When you finish the sign-up process for Crypto.com Tax, the first thing you need to do is log in to the dashboard and add your crypto wallets and exchanges. That way, the software will be able to track all your crypto assets and the transactions you’ve done.

As you can see in the photo above, all you have to do is choose the wallet or exchange you want to add and click it. Then, you just have to set a name for it.

After you’ve set the name, you then have to choose how you want to import your transaction data. You can choose to do the API sync, or you can upload the CSV file which is what I would recommend.

The reason why I suggest you do this is, that it will provide you with step-by-step instructions on how to get the CSV file from your wallet. The instructions are very accurate, so you won’t have a hard time getting the CSV file.

Once you’ve uploaded the CSV file, you are all set. If you are using multiple crypto wallets or exchanges, I would suggest you add everything.

Then, you can now generate tax reports accurately, which is what I will discuss next.

How to generate tax reports?

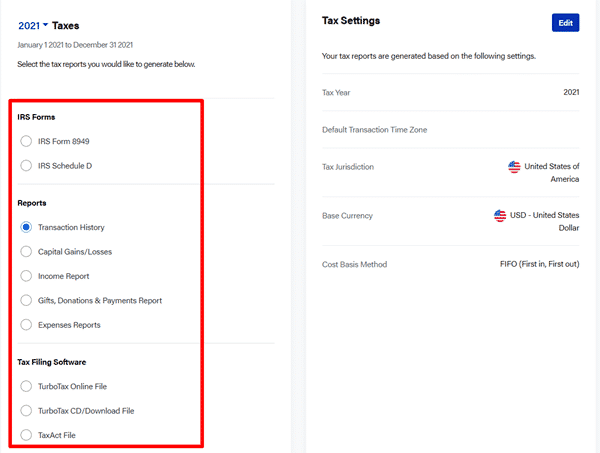

The great thing about the Crypto.com tax tool is that it will automatically generate a crypto tax report according to the tax settings you’ve set it to.

When you sign up, you will be asked to set the tax year as well as the jurisdiction. Then, the tool will show the options of the report you want. It will automatically display all the available forms, reports, and tax filing software options.

Just choose the option the report (left side of the photo above) is intended for and then choose the type of file you want it to be exported to. You can download the CSV or XLS version, which makes it a very flexible method of generating reports.

The options that will appear on the left side (refer to the photo above) will depend on the tax jurisdiction you have chosen during registration. You do have the option to change the tax settings according to your preference.

If you want to know which option you should choose, you have to talk to someone who knows the tax filing process of where you live (i.e. your accountant or local tax authorities).

Once you’ve generated the report, just give it to whoever needs the document.

The good thing about this process is that whichever option you choose, Crypto.com Tax will make it very easy for you to generate the report. I was really impressed with how user-friendly everything is.

Even if you don’t really have any idea of how to generate reports, you won’t have a hard time doing it because the tool gives detailed instructions every step of the way. You rarely find a tax tool that is very easy to use, in my opinion.

But I just want to make it clear that I am NOT a tax advisor, and it is therefore important that you talk to an expert in your local area or country to make sure you get everything right if you have any doubts.

Which countries is it available in?

While you will be able to use this tool anywhere in the world, there are only a few tax jurisdictions you can choose from. So, it effectively only works with the countries where it has the tax jurisdictions.

These countries are:

- Australia

- Austria

- Canada

- Denmark

- Finland

- Germany

- Norway

- Spain

- United Kingdom

- United States of America

They do say on the website that they are currently working on adding more countries to the choices. So, in a few months’ time, expect to see more jurisdictions included.

Now, even if your country is not listed above, you can still use this tool to review all your crypto transactions. You just can’t generate crypto reports yet. But who knows? Your country might be listed among the choices in the future.

Final Thoughts

Overall, I was really impressed with Crypto.com’s Tax tool. It has a lot of great features and best of all, it is very easy to use. I was even more impressed that they offer it for free because as mentioned earlier, most tax tools are quite expensive.

That’s why it comes as a welcome surprise that a free tax tool that is very useful and flexible is available online. So, if you are looking for a tax tool for your crypto assets, I would highly recommend you check out this one. It won’t cost you a dime and it is very easy to use.

And if you are looking for ways to also earn crypto for free so you have more to report with your crypto tax tool, you can check out this list of free ways to earn Bitcoin.

If you have any comments, questions, or you know of any other free crypto tax tool that is worth using, I would love to hear from you in a comment below.