Carrot Insurance is a website that claims you can earn rewards by being a safe driver. It sounds interesting, right?

If you are interested in what it has to offer, then I suggest you keep reading this Carrot Insurance review.

It will show you how the opportunity works so you will know exactly what to expect from it before you even sign up. Then, you’ll be able to figure out if this is a good fit for you or not.

What is Carrot Insurance, and what does it offer?

Carrot Insurance is actually a car insurance provider that will let you earn rewards if you have ongoing car insurance from them. It’s quite different from the usual sites I have tested, and yes, it is a legit site because you can really earn rewards from it.

However, that doesn’t necessarily mean it is a good fit for you. To find out if you should go for this opportunity, you must first understand how it works. The only way to do that is to examine the earning opportunity it offers so that you will have a clear idea of how much time and effort is needed to earn from it.

So, here’s how to earn from Carrot Insurance.

The earning opportunity – Buying an insurance

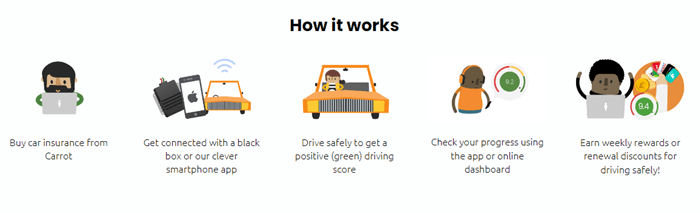

To earn from Carrot Insurance, you must first buy car insurance from them. Yes, this means you’ll have to spend money before you can earn from it. The amount you need to pay will mostly depend on the policy you go for. You can request a quote from the site on how much it will cost for the insurance policy you are interested in.

Once you have an existing insurance policy, you will be able to earn rewards simply by driving safely.

As to how you can earn, that will mostly depend on the policy you go for. If you opt for the Blackbox policy, Carrot Insurance will install a black-box device in your car so that it can track your driving habits.

Traditionally, black-box devices are used for airplanes, but they can also be used for other vehicles.

Carrot Insurance will install the device for free in your car, so you don’t have to worry about setting it up. Once it is installed, all you have to do is drive your car like you normally would, and the device will do all the work for you.

At the end of the week, you’ll receive Carrot points depending on your safe driver score. The higher your score, the more points you will receive. So, this opportunity will actually motivate you to drive safely, which is the best value this opportunity has to offer, in my opinion. I’m not sure exactly how they define driving safely, but expect them to be about following traffic rules among other things.

If you opt for the app policy, you won’t have to let Carrot Insurance install the device on your car. Instead, you’ll just have to download their mobile app (which essentially does the same thing as the device). Once the app is installed and set up, you’ll just have to proceed with your normal driving routine. Again, at the end of the week, you’ll also receive Carrot points depending on your safe driver score.

Lastly, if you choose the Safe Driver policy, you’ll be able to receive rewards at the end of the year depending on your safe driver score. For this policy, you’ll still have to use either their device or their app.

This opportunity will let you earn rewards passively, as long as you practice safe driving habits, of course.

Recommended: Check Out the Best Passive Income Apps

How do you get paid?

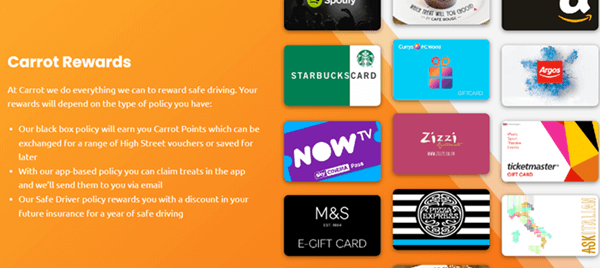

As explained above, you’ll earn Carrot points by driving safely. These points will determine your weekly safe driver score. If you get a green score at the end of the week, you’ll be eligible to redeem a “treat” from Carrot Insurance.

These treats are actually gift cards from stores like Amazon, Starbucks, Argos, and more. To claim the treat, you’ll have to log in to the app and click the Claim button within 7 days of receiving the treat.

Once you’ve claimed the treat, it will be sent to you via email within 14 days. You will not earn cash rewards from Carrot Insurance’s earning opportunity. The closest thing to cash rewards you could get from it is the discount you will receive if you opt for the Safe Driver policy.

As mentioned earlier, at the end of the year, if you get a green score with your Safe Driver policy, you’ll get a discount on your future insurance. So, in effect, you’ll be saving a bit of money if you decide to renew your insurance.

Overall, the reward system of Carrot Insurance is relatively straightforward. However, if you prefer to earn cash, I suggest you check out the top sites that pay via PayPal instead.

How much money can you make?

The value of the treat you can earn from Carrot Insurance will mostly depend on your score. Expect these treats to be worth at least £5 to £10, which is not a bad rate if you can get it weekly, in my opinion.

But of course, it will depend on your driving habits. So, to put it simply, the amount you can earn from Carrot Insurance will depend on how safe a driver you are.

Overall, I would say the earning potential of Carrot Insurance is quite decent. However, you also need to keep in mind that you have to buy an insurance policy from them before you can earn. So, in the end, the total amount you can potentially earn from it will just cancel out the amount you had to pay for the insurance policy.

But as I’ve said earlier, the best value this opportunity offers is not the rewards you can get but the safety habits you can develop while driving. That’s much more valuable, in my opinion.

Can you use it on mobile?

As explained earlier, Carrot Insurance has a mobile app you can install so you can earn rewards without installing their black-box device. This app will also let you claim your weekly rewards.

There’s not much information about the app, and you won’t be able to download it from any app store. Instead, once you’ve bought an insurance policy from Carrot Insurance, you’ll be given the download link for the app. So, it’s not something you can try out for free. However, expect the app to work for both Android and iOS users.

Who can join Carrot Insurance?

Carrot Insurance is a UK-based insurance company, so the only people who are eligible for this opportunity are those who live in the UK. If you are interested in more passive income opportunities in the UK, I recommend you also check out how to earn a passive income in the UK.

To join, you must first buy an insurance policy from them. Of course, it goes without saying that you’ll need to own a car before you are eligible for an insurance policy.

After you’ve bought your policy, you won’t need to sign up for their rewards program. You’ll automatically receive your login details for their member dashboard. So, there's actually no registration process involved.

Once your policy is in effect, you will be able to start earning rewards from Carrot Insurance.

Can you get support?

If you have any questions about Carrot Insurance, you can check out its Help Center. It discusses everything you need to know about the earning opportunity, as well as their insurance policies.

If you can’t find the answers you are looking for, you can contact their support instead. To do so, you can click the chat icon found in the lower right-hand corner of the website. This icon will let you chat with a support representative. Just remember that this function is only available during business hours.

They also have a number you can call on their contact page. Overall, I would say the site provides decent support for its members since it offers a couple of convenient ways for you to get assistance.

Final Verdict

Carrot Insurance is an insurance company that will let you earn rewards from the insurance policy you buy from them. It has a couple of good features, but it also has some limitations you must consider.

To help you with your decision, I have summarized its pros and cons to give you an overview of what it has to offer.

Pros:

- Offers a passive form of earning

- You can develop safe driving habits from its earning opportunity

Cons:

- You have to spend money to start earning

- Doesn’t offer cash rewards

In my opinion, Carrot Insurance is not for everyone. If you don’t own a car or if you already have an existing car insurance policy and you are happy with it, then there’s no point getting an insurance policy from them just to earn. It’s not worth it, in my opinion.

But if you are in the market for a car insurance policy, you can go for it. However, before you do, I suggest you check out their policies first and see if you like them. If you do, then you can go ahead and get one so you can start earning rewards.

Now, if you are just looking for ways to earn rewards, I suggest you check out the top survey and GPT sites in your country instead. The sites and apps on this list all have good earning potential, so you can earn a good amount in no time.

Plus, you will definitely find a site or app you can join regardless of where you live.

If you have any comments, questions, or experiences with Carrot Insurance, I would love to hear from you in a comment below.