Are you looking to lower your monthly expenses? If so, there’s a site called Rocket Money that claims it can help manage your finances by cutting off unwanted subscriptions and more.

It’s certainly an interesting offer, but before you register, I would suggest you read this Rocket Money review so you’ll learn more about everything it has to offer. That’s the smart move, in my opinion.

And the first thing you need to know is if it is legit or another scam designed to get your banking details. Let me answer this right away because this is an important piece of information you need to know right away.

Yes, it is legit. It will really help you identify which aspects of your monthly spending you can cut off so you can save a bit of money.

But is this worth it? Well, read on and find out.

What is Rocket Money, and what does it offer?

Rocket Money (formerly known as Truebill) is a financial management platform that will help you identify areas in your monthly expenses you can cut off so you can save money. It’s essentially a tool that can help you lower your monthly bills and track your spending.

But to fully understand how it works, we first have to take a look at the “earning” opportunities it offers. So, here’s how to earn “earn” from it.

Option 1 – Financial Management Features

Let me just make it clear right away that you won’t, as such, earn money by using it. Instead, as explained above, you will be able to save money by canceling subscriptions you don’t need to lessen your monthly expenditure.

Hence, you will be saving a bit of cash, and as the saying goes, “Money saved is money earned”. That’s how it will be able to “earn” you money.

When you sign up as a member, you will be given access to a bunch of features that Rocket Money offers. Simply choose which ones you want to use after registering. The main tool that can help you save money is the “Cancel Subscriptions” feature.

What it does is it identifies all the monthly subscriptions tied to your bank account or credit card. Then, all you have to do is choose which subscriptions you want to cancel. To do this, you first have to connect your bank account or credit card to it.

Once you’ve connected your account/credit card, it will scan the account and show you all the subscriptions connected to that account/credit card. Take note that for this to work, you must connect the account used to pay for these subscriptions.

You can then cancel the subscriptions you don’t want. But if you want Rocket Money to do it for you, you will have to become a premium member. You can choose on a sliding scale between $3-$12/month for their premium services. The $3 and $4 options are billed annually, while the other options will be billed monthly.

And speaking of premium subscriptions, once you become a premium member, you will gain access to more features that can help you save money or even manage your budget. One feature that is unique is their “Bill Negotiation” feature.

This feature will allow Rocket Money to negotiate your monthly bill for certain subscriptions on your behalf. They will do all the negotiation for you, but in return, they will charge you a service fee, but only for successful negotiations.

Say, for example, if you want to lower your monthly mobile phone subscription, it will negotiate with your network carrier, and if they can successfully get a deal, you will have to pay Rocket Money 30% to 60% of the total amount you can save through the negotiation. So, essentially, you will be sharing your savings with it since they were the ones that made it happen.

You have to indicate the percentage when you submit the negotiation request though. So, you have to choose wisely. The good thing is, they’ll send you a breakdown of the negotiation, so it’s always transparent.

There are other features that you will gain access to when you become a premium member but I won’t go into details since they are mostly just tools that will help you manage your budget. The two that I’ve explained (subscription canceling and bill negotiation) are the primary ways you will be able to save money.

Option 2 – Affiliate Program

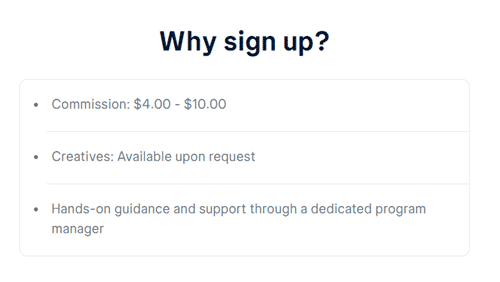

Rocket Money also has an affiliate program you can join so you can earn. If you are not familiar with what an affiliate program is, by definition, it is an advertising model in which a company compensates third-party publishers (you) to generate traffic or leads to the company’s products and services.

In Rocket Money’s case, you can invite other people to sign up as members. In return, you will receive around $4 to $10 as a commission. To join their affiliate program, you have to sign up through the Impact platform.

Once you’ve done that and have been approved, you can get your affiliate link or banner (whichever you prefer) and share it with people you want to invite. When they sign up using your link or banner and link their account/card, that’s when you receive your commission.

It’s a bit more complicated compared to your usual referral program from an online rewards site, but the logic is the same. You have to get people to sign up as a member of the platform to earn.

Recommended: Check Out the Top Cashback Sites

How do you get paid?

As explained above, there’s only one way to earn from it, and that is through their affiliate program.

Depending on the specific terms of your agreement with Rocket Money, you can get paid as frequently as daily using direct deposit into your bank account.

So, there’s no set time for when you can get paid, and you don’t need to earn a certain amount to get paid. It will all depend on your agreement with Rocket Money. But I do like the fact that they offer a convenient payment method like direct bank transfer.

If you are interested in more sites that offer this kind of payment method, I would recommend you check out the top sites that pay via direct bank transfer.

How much money can you make/save?

The amount you can save from using Rocket Money will mostly depend on what it can identify from the accounts linked to it. If you have plenty of subscriptions that you have forgotten about or are not aware of, then you stand to gain a lot from using it.

But if you are very careful about which subscriptions you have, then you stand little to gain from it. In terms of actual money you can earn from their affiliate program, that would depend on how good you are at inviting people to use the platform.

That’s a skill that not everyone has. So, I would say the earning/saving potential will depend on the person using it. That’s why it’s pretty hard to give an exact figure of how much you can save or earn from it.

But if you aren’t good at managing your finances or you’ve exhausted all means to find ways to cut down on your expenses, using Rocket Money is worth a shot, in my opinion.

Can you use it on mobile?

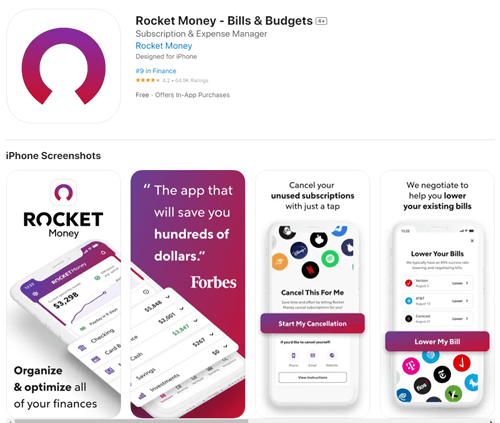

Rocket Money has an app you can download so you can use it conveniently even when you are not in front of your computer.

Their app is available for download on both Android and iOS app stores. It is also very user-friendly. So you shouldn’t have any problems getting used to how it works.

I would recommend you download it especially if you use their financial management features like keeping track of your spending and budget allotment. That way, you can check your budget or spending anytime, anywhere.

Who can join Rocket Money?

While you will be able to register as a member of Rocket Money regardless of where you live, it is only really available in countries where the banks and financial institutions that it can connect to are available. It uses Plaid to connect your bank account to the platform.

So, the best way to find out if you are eligible to join is to check the list of banks and financial institutions that Plaid supports on their website (see link above).

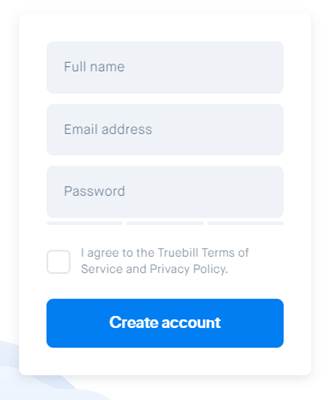

Also, you need to be at least 18 years of age to register as a member. As shown in the photo above, to register, you just have to fill out their sign-up form. Alternatively, you can also use your Google account to sign up.

Once you’ve submitted the form, you will be asked to connect your account/credit card to it. When you’ve done that, it will also ask you to download their app. After everything is set up, you can now start using Rocket Money.

Can you get support?

If you have any questions about the platform, you can check out their Help page first. It discusses the most common topics you need to know. If you can’t find the answers you are looking for, you can submit your inquiry through the message icon in the lower right-hand corner of their Help page.

You can also use the contact form provided on their website or inside the app. Overall, I would say they provide good support for their members since they offer multiple ways for you to get in touch with their support.

Final Verdict

Rocket Money is a legit financial management platform that will help you find ways to save money. It has a couple of interesting features but it also has a few drawbacks you need to keep in mind.

Let me wrap up this review with a summary of its pros and cons to give you an overview of what it has to offer. Then, you can decide if this is a good fit for you or not.

Pros:

- Their app is user-friendly

- Your banking information won’t be compromised

- Their affiliate program pays a decent amount

Cons:

- Most of their features can only be accessed if you become a premium member

- Limited payment methods

Rocket Money, in my opinion, is not for everyone. If you are good at tracking your finances and are careful with your subscriptions, there’s no need to use it. This platform is only really intended for people who are too busy to keep track of their finances and are looking for ways to optimize or minimize their spending.

If you are looking to earn extra cash, then this is not for you. I would suggest you check out the top survey and GPT sites in your country instead. The sites on this list all have good earning potential and they all offer easy ways for you to earn extra cash and even gift cards.

Plus, you will definitely find a site you can join regardless of where you live.

If you have any comments, questions, or experiences with Rocket Money, I would love to hear from you in a comment below.